The Current Real Estate Market in the United States

Swich

Not Looking Good

The real estate market definitely isn’t looking great to say the least, but we need more pain before the types of drops that so many on social media and on TV are calling for (also most young people hoping for a huge drop let’s be real) to actually happen. That magnitude of a drop could definitely happen, but not for the reason most people think.

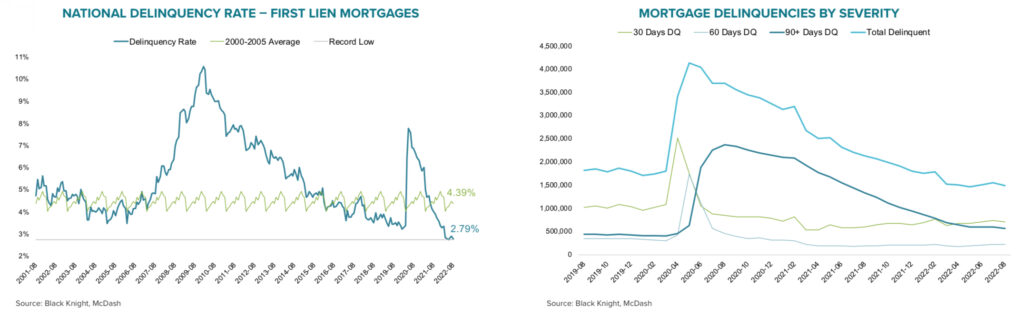

This is because the state of mortgages in the US are nowhere even in the same universe as during/before the Great Financial Crisis no matter what most ignorant influencers are saying. Again, I want to reiterate, a 2008 size drop in the US real estate market is definitely possible, but it’s not going to originate from the same place it did in 2008.

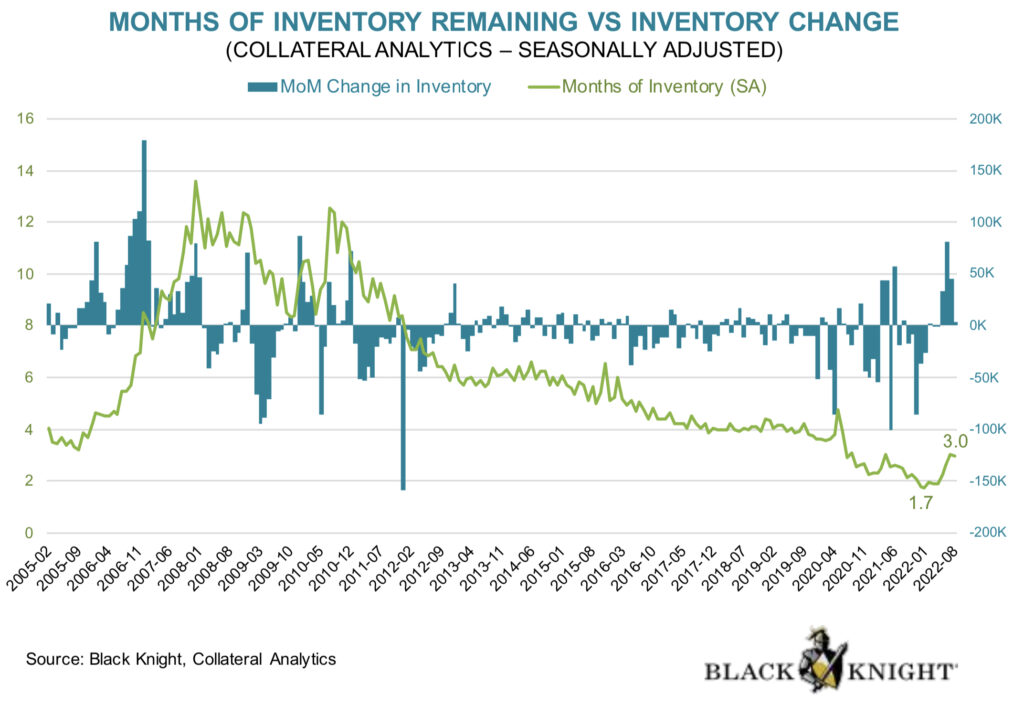

There also isn’t as much of a supply increase yet, at least not to the magnitude some are making it out to be. To say that the real estate market is in worse shape than 2008 is insane. Again, this doesn’t mean that huge drops in the real estate aren’t possible. I know I keep repeating this but some people get really triggered if you even suggest that it’s not worse than 2008. Sovereign debt on the other hand is a different story, especially in emerging markets.

Short-Term Inflation Peak?

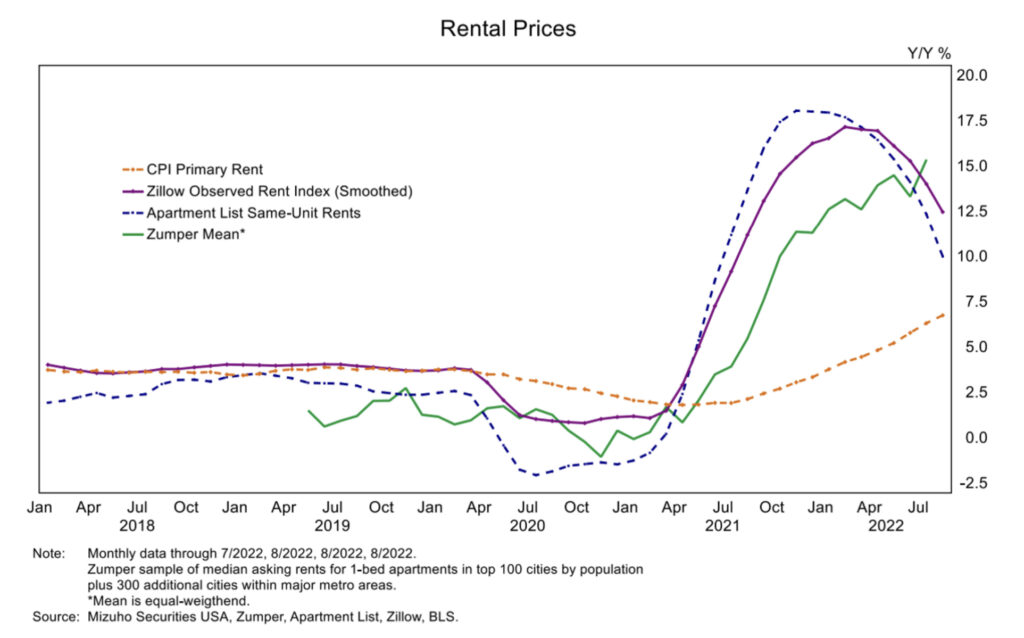

In this case we’re mostly talking about shelter inflation, but overall inflation is obviously relevant too. The thing is, we’re looking at a situation where actual shelter inflation has already peaked and is going down fast, but the CPI rent number is still going up because of the way they measure rent, let me explain.

To measure CPI rent, what they do is use something known as “owner’s equivalent rents,” which includes current rent being paid from a lease signed months ago. I don’t think I have to explain much further why that would make it lag real rents so much because it’s pretty self explanatory.

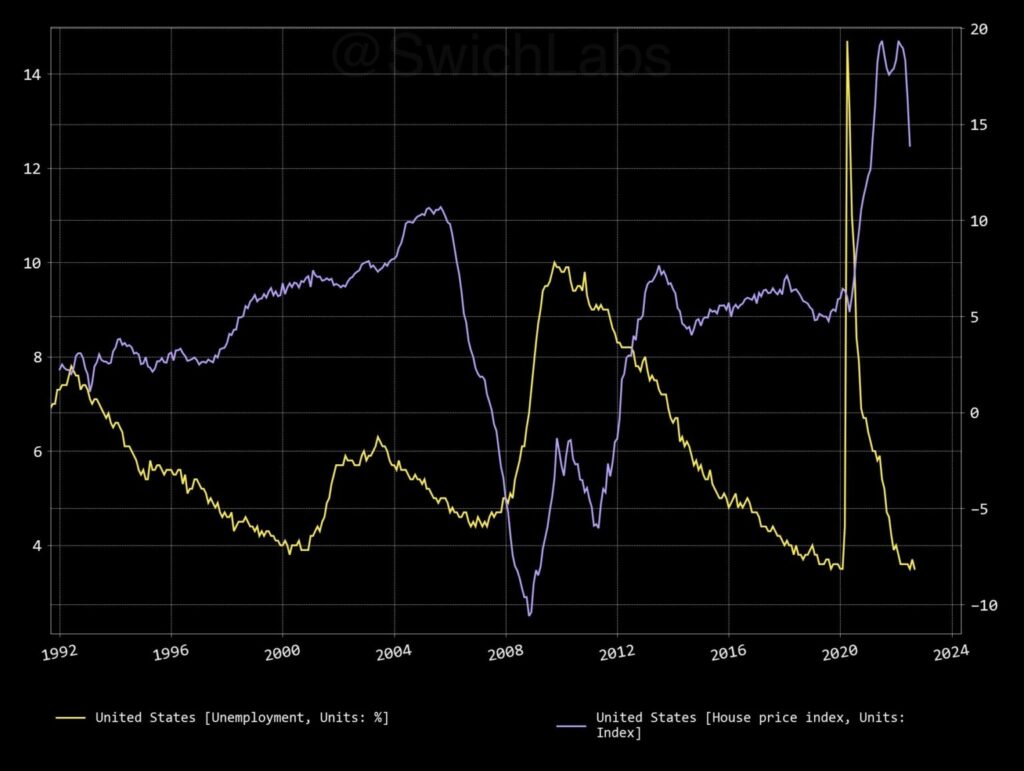

Unemployment Needs to Rise for Prices to Drop 25%+

Unemployment going up has to happen to have that huge of a drop in real estate, but it’s even more required now with the mortgage situation. Most people have an insane amount of equity and the ones that don’t locked in a super low interest rate, there is no incentive to sell without job loss.

USA Real Estate Prices (YOY Change) vs Unemployment

It’s hard to imagine a scenario where unemployment doesn’t rise from inflation effects alone. Even if inflation drops fast, unemployment will most likely still rise, but it would definitely help a lot if that were to happen. The thing is, things like the lagging CPI rent make it look like the Fed might take even longer to pivot. Because they’re looking at a heavily lagging indicator for shelter inflation as explained before.